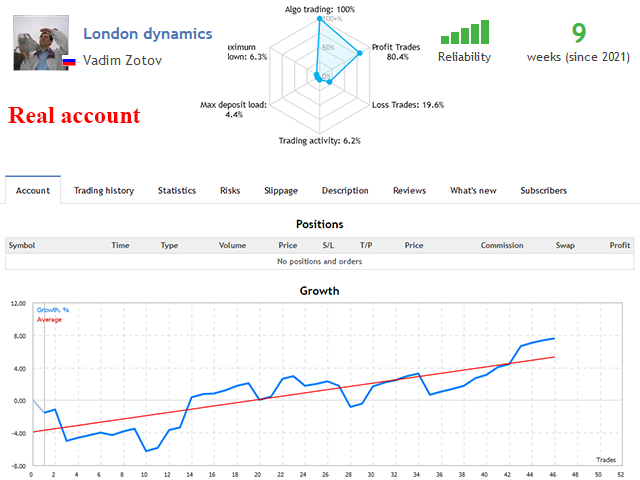

London Dynamics 3.1 MT5 (Patch)

Trading during the London session based on the analysis of market dynamics. To open a deal, the robot uses data from the Asian and London sessions. Trading is performed on the basis of accurate calculations and forecasts, without indicators, without risky strategies such as martingale. Trades are protected by stop loss. Minimum balance from $ 10.Features of the strategy

During the Asian session, exchange rates usually come to some kind of steady state with small fluctuations. When the London Stock Exchange (LSE) goes live, disbalance occurs. The volatility of the markets is increasing, which can provide good price movements for profit. These movements are detected by the London dynamics robot. At a specified time, it records price deviations from the values of the Asian session. At the same time, it distinguishes false breakouts of the Asian flat from the real ones. During the specified time of the London session, the robot continuously calculates the dynamic characteristics of the market, predicts price movements and concludes deals. Trades are placed only according to the trend determined by the gradient. The use of complex criteria for decision-making ensures high accuracy and profitability of trading. Using stop losses beyond reasonable critical levels provides optimal reasonable risks. The risk can be set by the user. There is a choice of different methods for calculating stop loss and take profit.Options

- Comment — comments on the settings (any text);

- Language — message language of the robot (Eng / Rus);

- Magic — magic number for positions;

- Show criteria table — show criteria table on a graph (Yes / No);

- Lot selection — lot management method (Automatic money management/ Fixed lot);

- Lot for 1000 units of free margin — lot per 1000 units of available funds of the base currency (for automatic money management);

- Fixed lot — fixed lot for work without money management;

- Max risk percentage — maximum risk per transaction, indicated as a percentage of the deposit (optimal 1-30%; 0 – not controlled);

- Min Profit/Loss — minimum acceptable ratio Profit/Risk (optimal 0.1-1.5; 0 – not controlled);

- GMT offset in the terminal — time zone in the terminal of your broker, (-11 … + 12) hours;

- Opening hour of the Asian session, GMT;

- Opening hour of the London session, GMT;

- Closing hour of the London session, GMT;

- Integration step — integration step in calculations, (1-10) sec;

- Time constant — time constant of the aperiodic link of the speed filter, (10-100) sec;

- Speed Criterion of price, points/min;

- Minutes to make a decision — number of minutes to decide on entry after the start of the London session (1-360) min;

- Gradient calculation method — method for calculating the trend gradient (0 – not taken into account, 1, 2 – by daily candles, 3, 4 – by imbalance of trading sessions);

- Min gradient — gradient above which it is allowed to enter the market, points;

- Stop loss calculation method — method for calculating stop loss (1 – behind the extremum of the previous day’s candlestick, 2 – behind the opposite border of the Asian session flat, 3 – behind the 61.8% fibo level within the Asian flat, 4 – behind the 38.2% fibo level within the Asian flat);

- Take profit calculation method — take profit calculation method (1 – according to the last imbalance, 2 – according to the imbalance of two days);

- Disbalance Coefficient to calculate TP — share of disbalance for calculating take profit (0.1-1);

- Clearance — clearance behind characteristic levels, points.

Features of use

The optimal timeframe is H1. Minimum deposit of $ 10 for one currency pair. Default parameters for EURUSD, H1. Simultaneous trading on several currency pairs is recommended, this provides more stable trading with less risks. In this case, it is desirable to decrease the Lot for 1000 units of free margin parameter, it is divided by the number of pairs. New set files will be uploaded here on the Comments page. The robot is easily optimized for other currency pairs and timeframes.