- Identifies breakout levels in price patterns

- Resistant to high ping environment

- Calculated hedging mechanism (Set B)

- Pending orders to minimize slippage

- No risky strategies e.g. grid or martingale

- Strict stoploss on every order

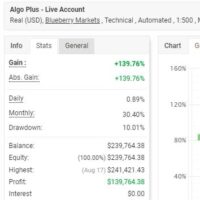

- Survived long term backtest of 99.9% modality

- No overfitting

- Hedging account

- Low spread raw ECN broker

- Currency base: no limit

- Autolot calculation based on USD

- Adjust autolot risk level according to the exchange rate if you use other currency

- Minimum recommended deposit: Depends on your risk level (see below)

- Two very different strategies are derived from the same EA

- Recommended to run Set A & B in separate accounts

- Set A

- Currency pairs: USDJPY(main), EURUSD, GBPUSD, USDCAD

- Timeframe: M30

- Settings:

- USDJPY: Default set file

- Other Currencies: Set file attached in “Comment” section

- Lotsize per 0.01lot:

- Low risk-350; Moderate risk-250; High risk-150

- Set B

- Currency pair: USDJPY

- Timeframe: H1 & H4

- Settings:

- Either H1 Set1(conservative entry) OR H1 Set2 (aggressive entry)

- And H4 set

- Lotsize per 0.01lot: (manual lot recommended)

- Low risk-550; Moderate risk-400; High risk-250

- Download the EA on your MT4 terminal

- Download the additional set files from the #1 comment in the “Comment” section

- Open the chart of the corresponding currency with the right timeframe

- Drag the EA onto the chart and load the corresponding set files

- Choose your own lotsize settings and risk level

- Allow autotrading

- Backtest result is based on historical data which does not guarantee future performance and profit

- Trade with an amount and a risk level you feel comfortable with

- Start with a demo account to understand the EA mechanism first

- A good ECN broker with low spread is essential. Message me if you don’t have one